Payslips, bank statements, broker statements, tax returns and other income verification documents require manual review and slow down time-to-decision and time-to-cash in consumer lending.

Instabase for Consumer Lending

Instabase automates document understanding for complex documents needed for identity and income verification in consumer lending in an end-to-end workflow.

Processing Consumer Loans

Why Instabase?

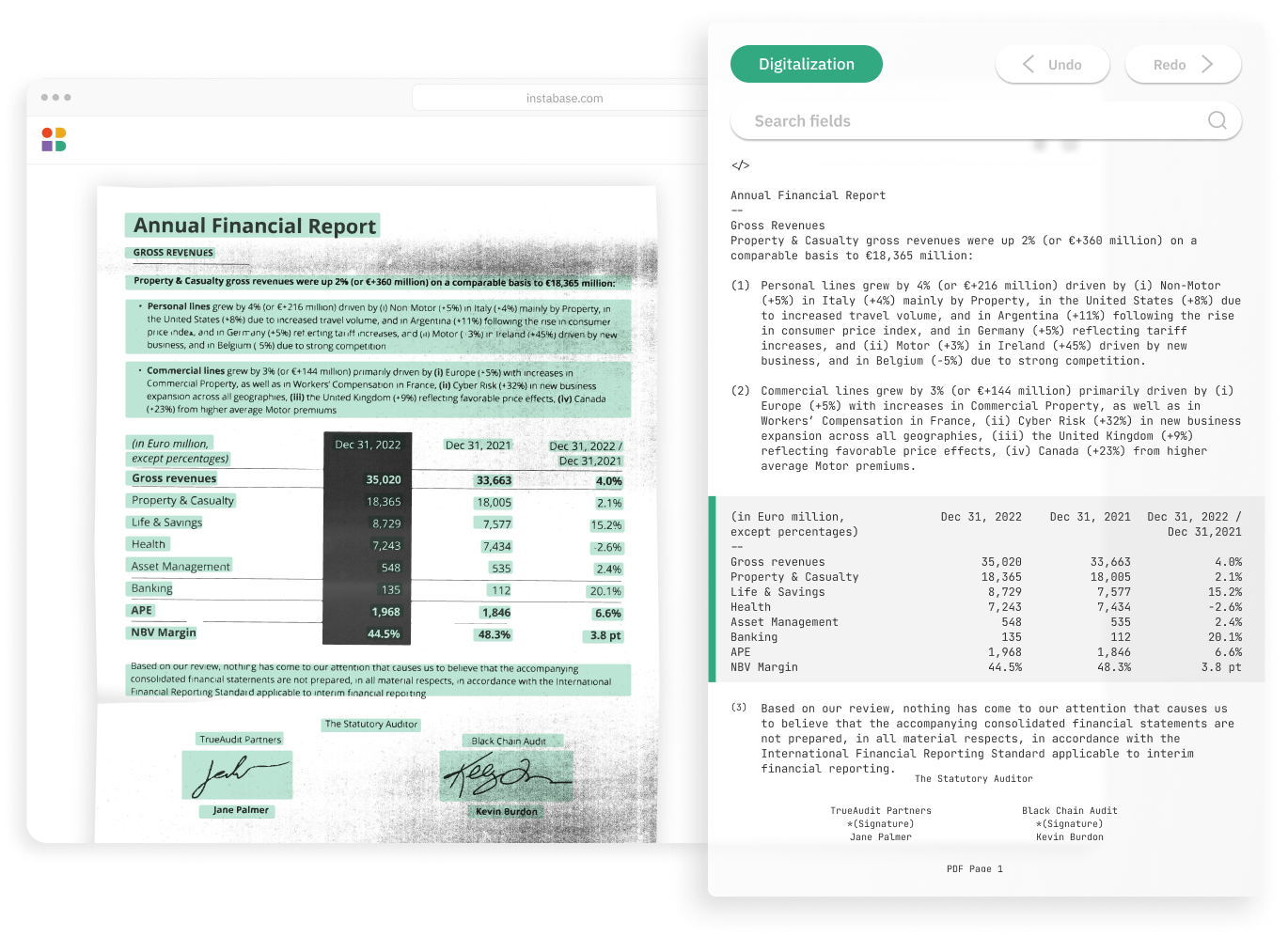

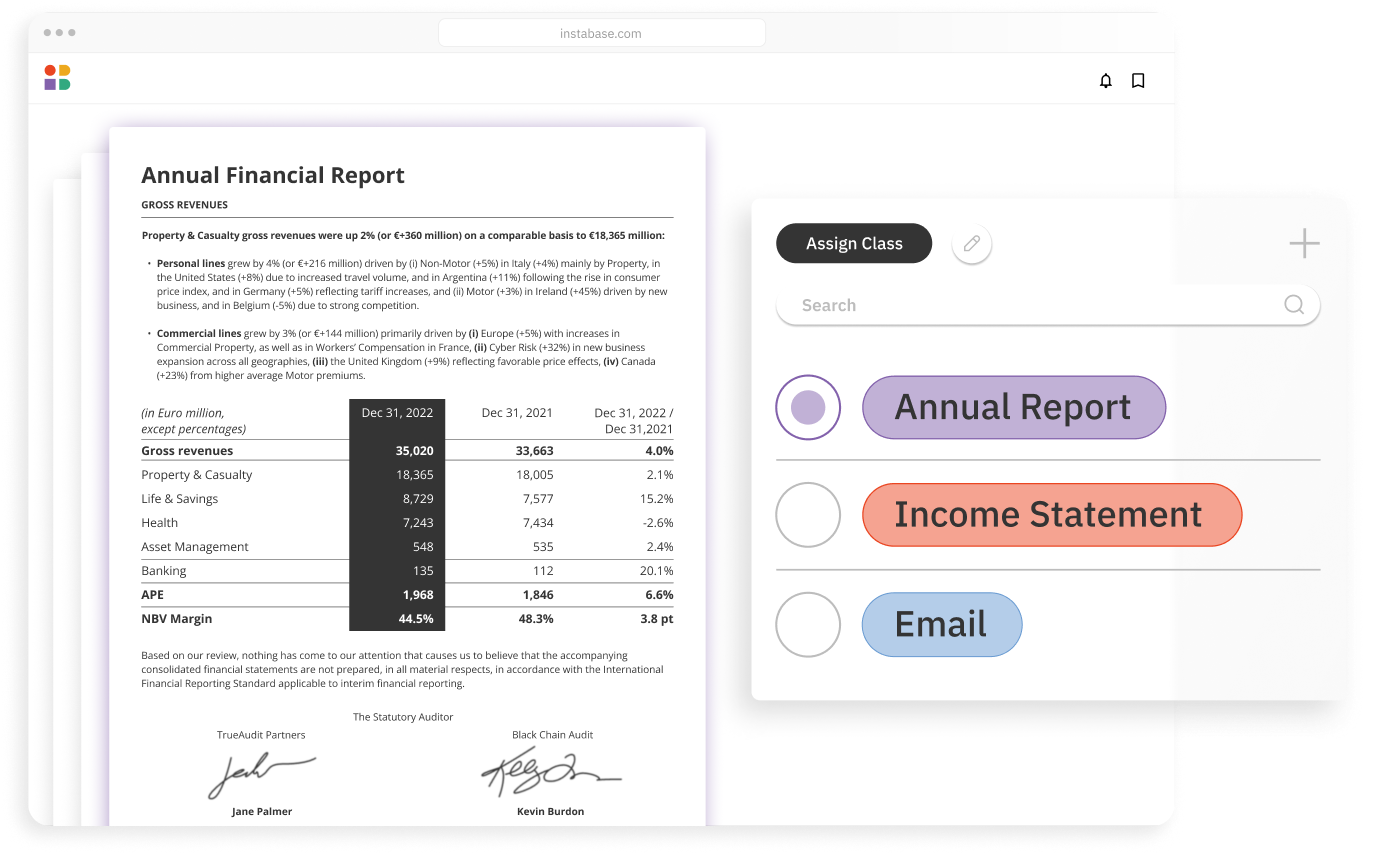

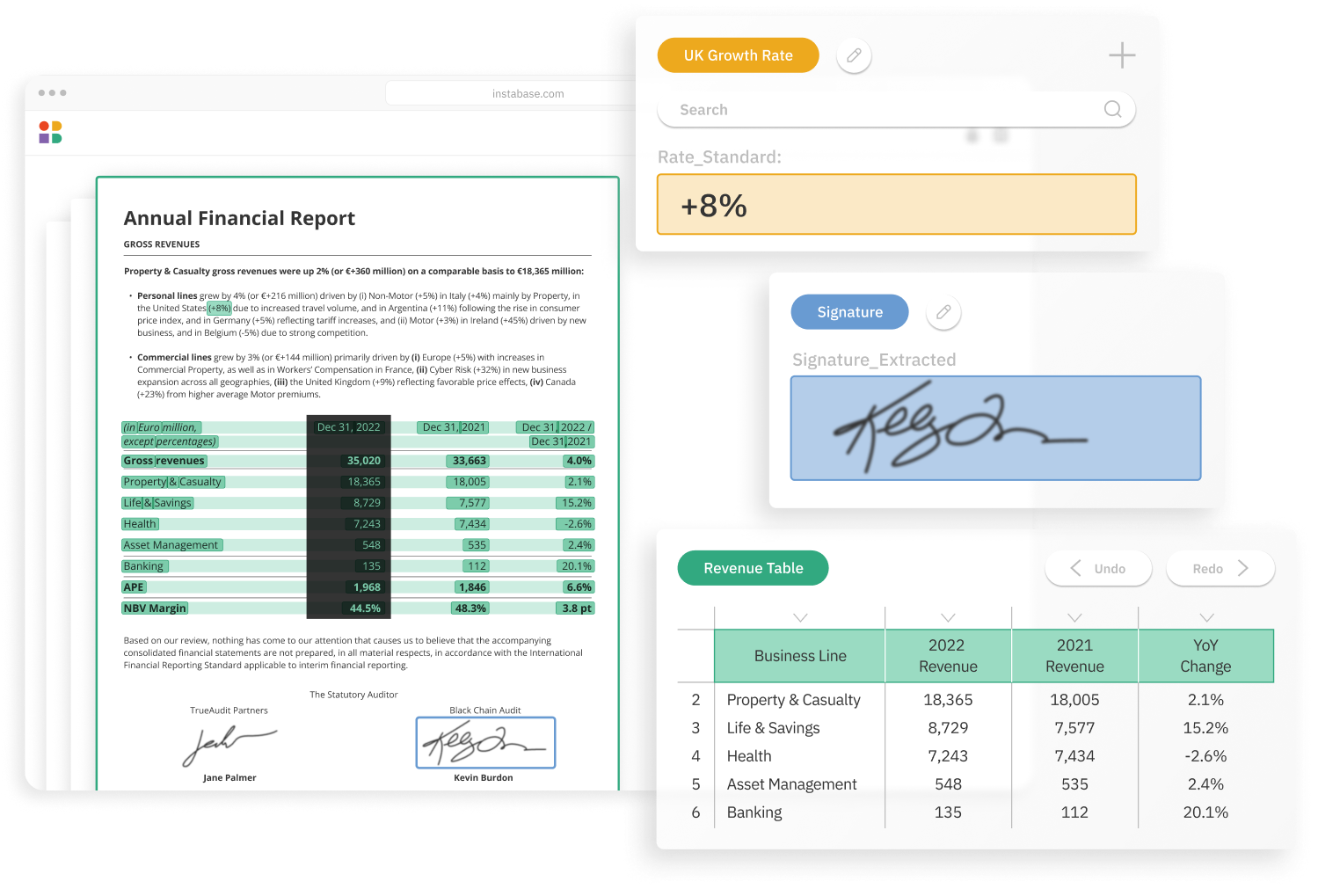

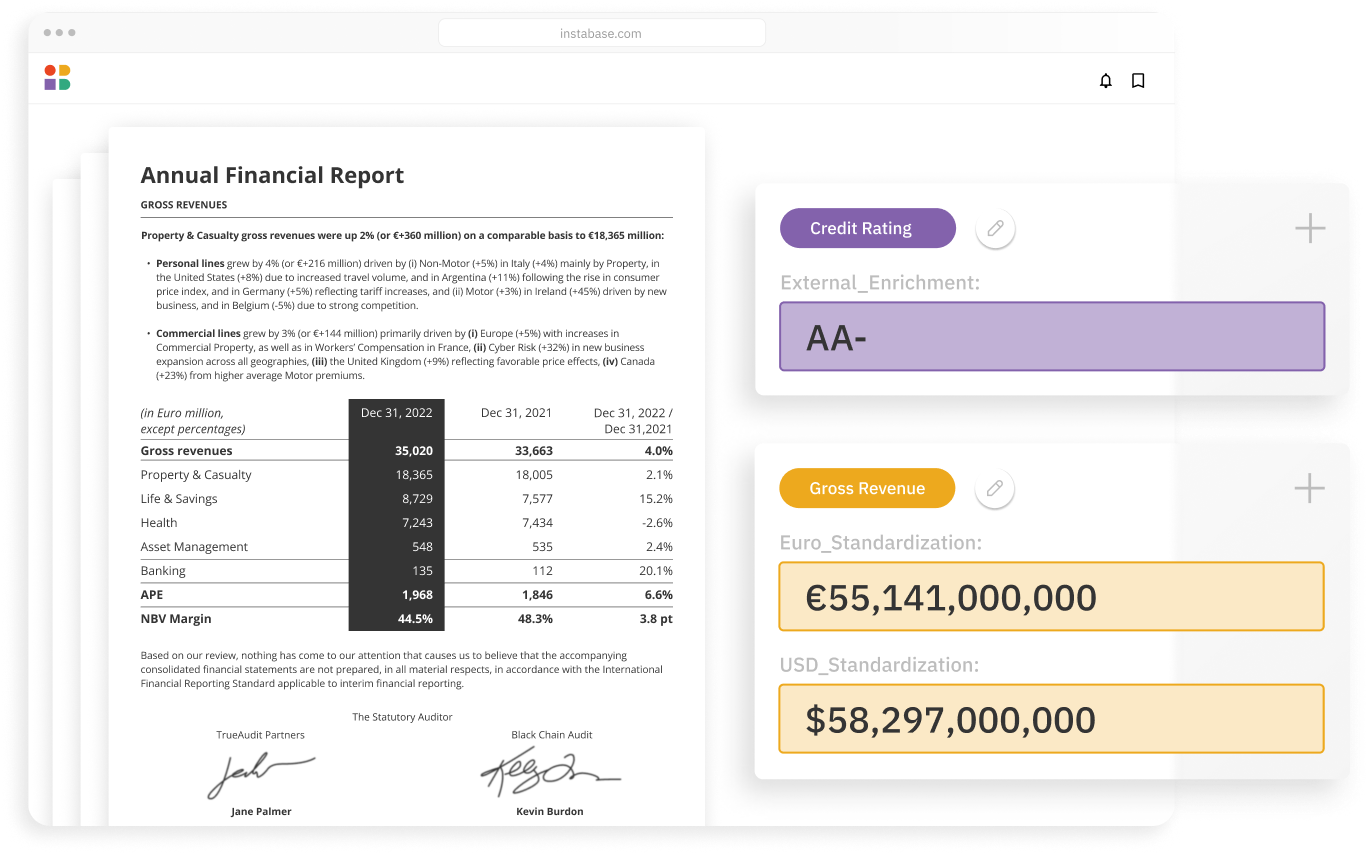

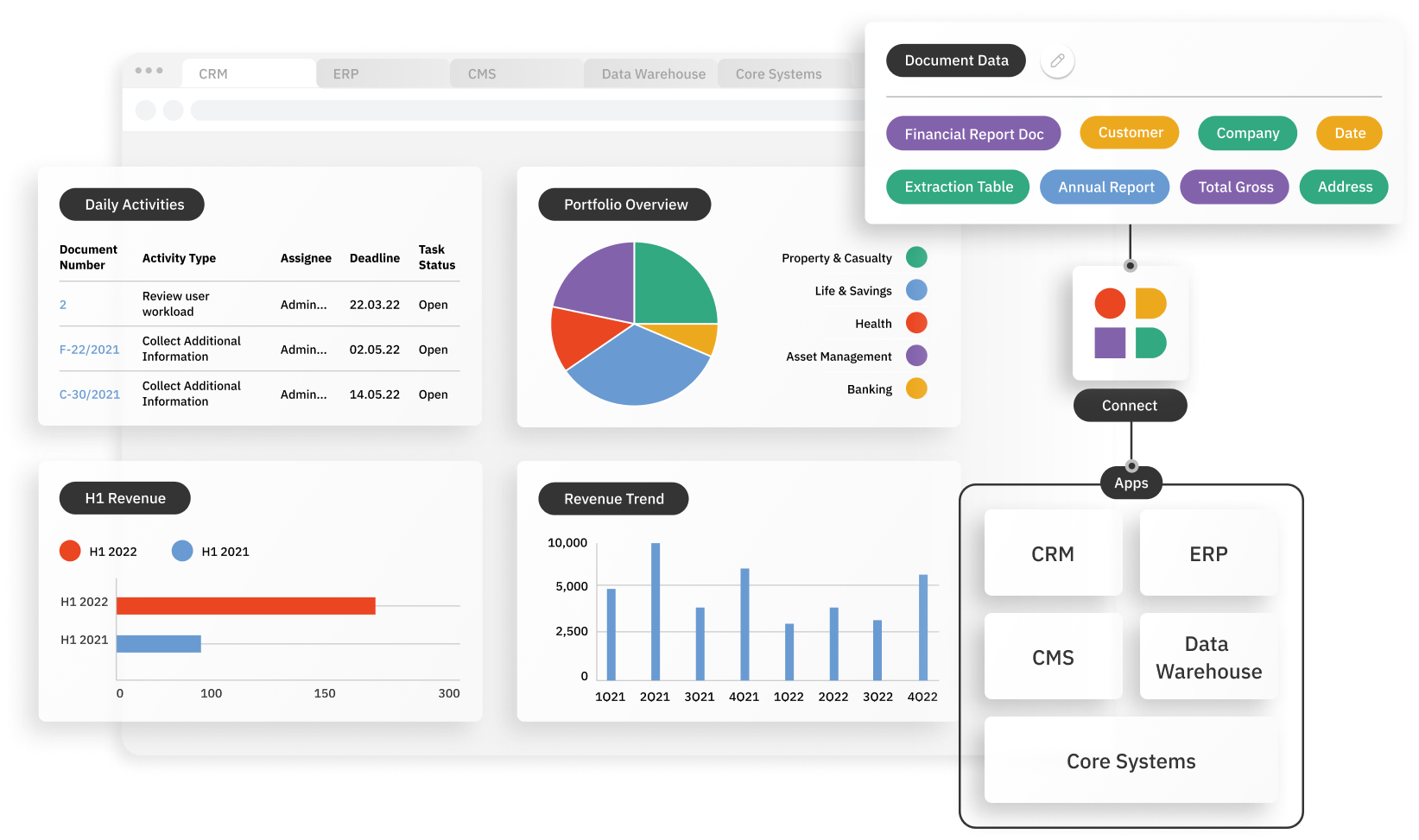

The Instabase Automation Platform for Unstructured Data automatically splits up document packets, digitizes, extracts, and validates borrower data from documents, allowing lenders to achieve a streamlined underwriting process with faster decisions, lower costs, and more scalability.

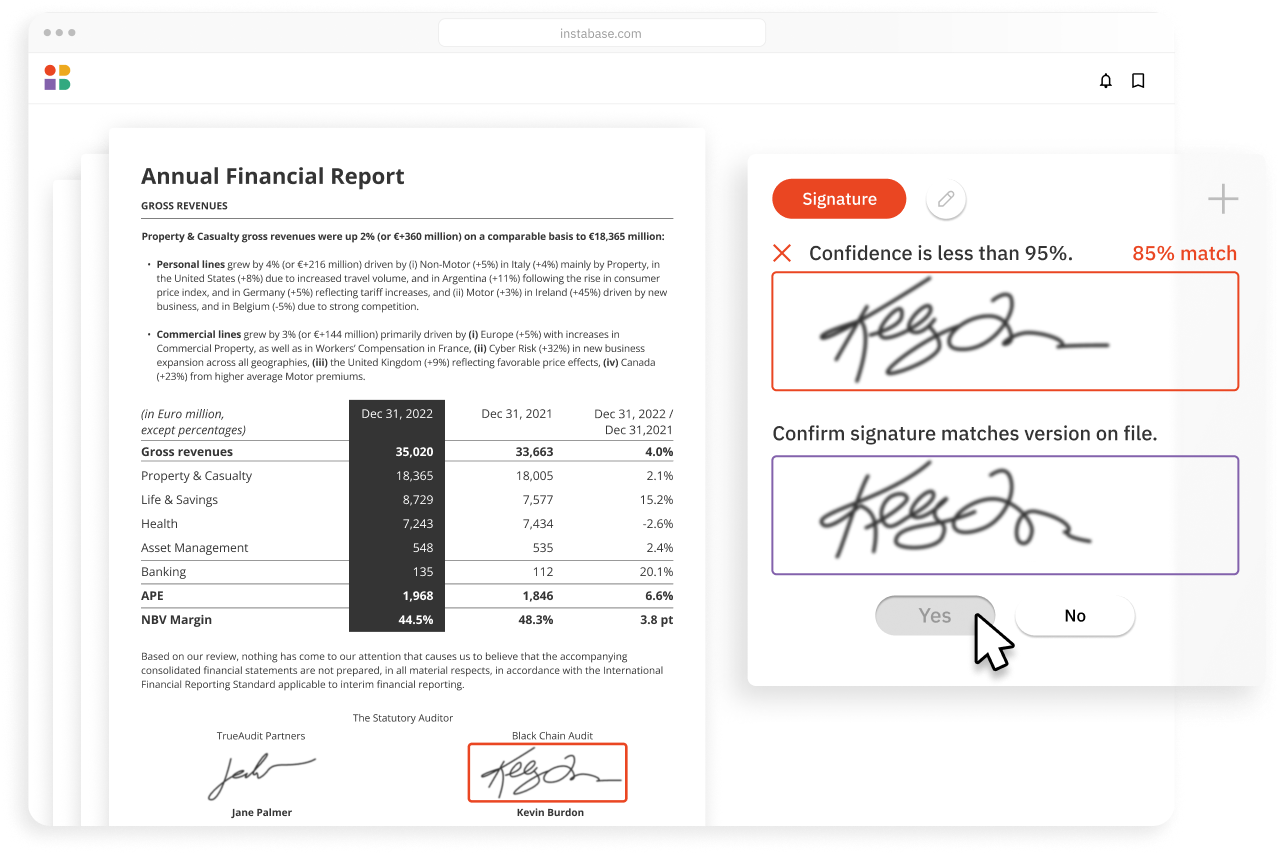

Unlock unstructured data that others can’t

Understand your most complex documents with the latest in AI from Instabase and the broader market

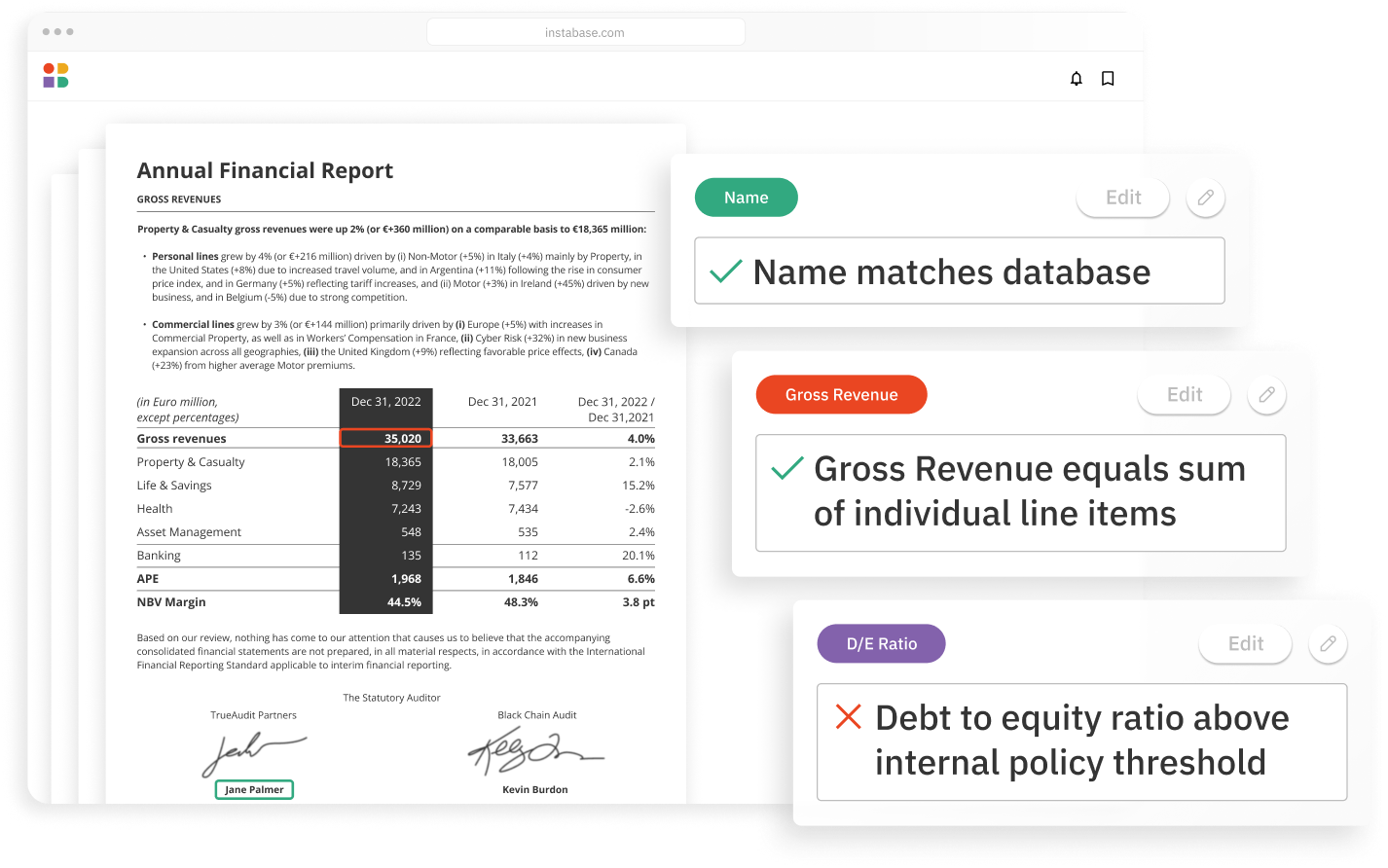

Achieve unrivaled automation & accuracy

Minimize errors and boost automation with an extensive suite of validations and business logic

Build solutions 10x faster

Launch end-to-end solutions in days with low code building blocks for every step in your workflow

How it works

Instabase combines the most powerful technologies for every step of the process, so you can automatically understand any document in the submissions process.