Income and identity documents like passports, employment letters, payslips, bank statements, and tax returns are largely unstructured documents, creating bottlenecks in mortgage origination due to manual review processes.

Instabase for Mortgage Origination

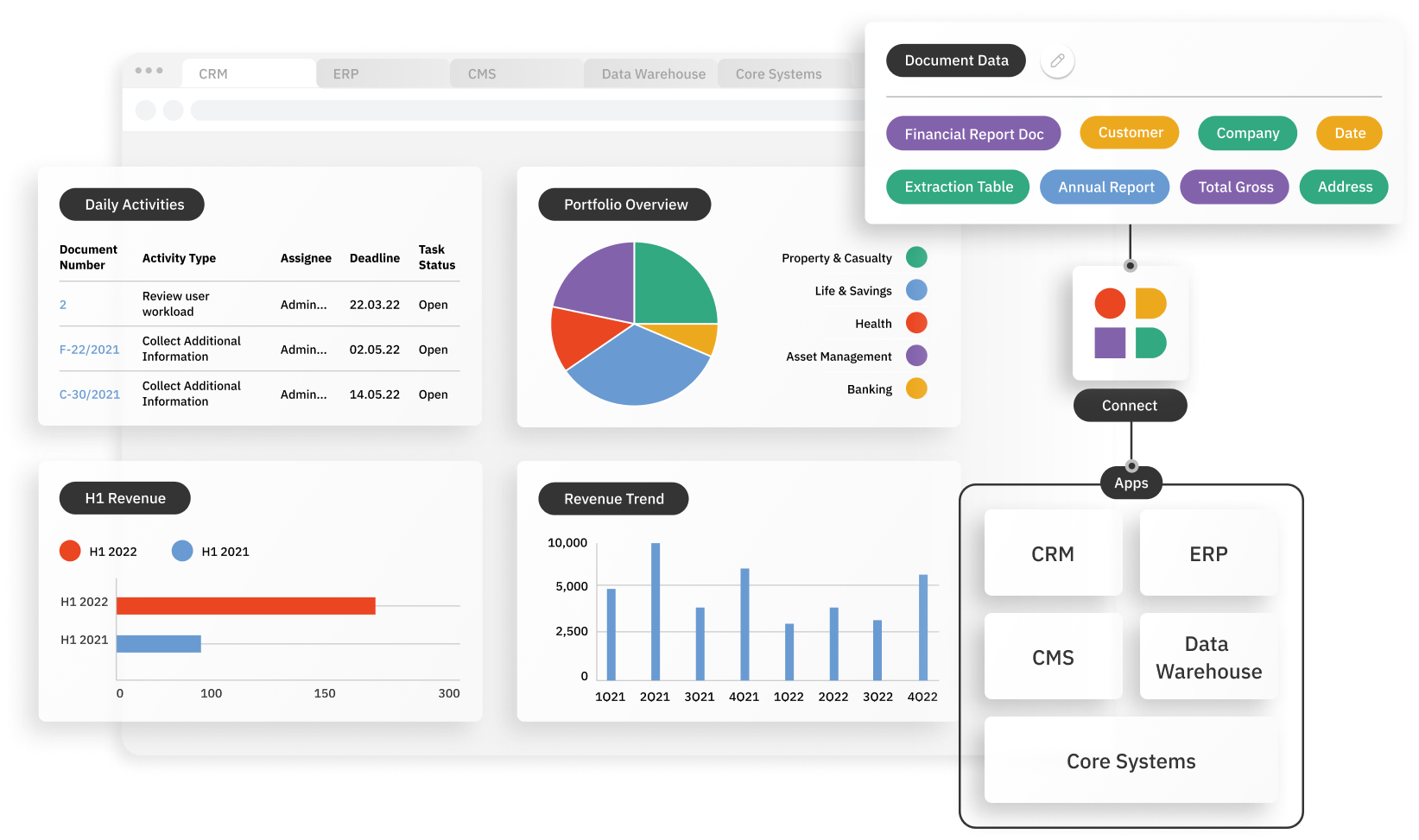

Instabase automates document understanding of complex documents involved processing mortgage applications in an end-to end workflow.

Processing Mortgage Applications at scale

Why Instabase?

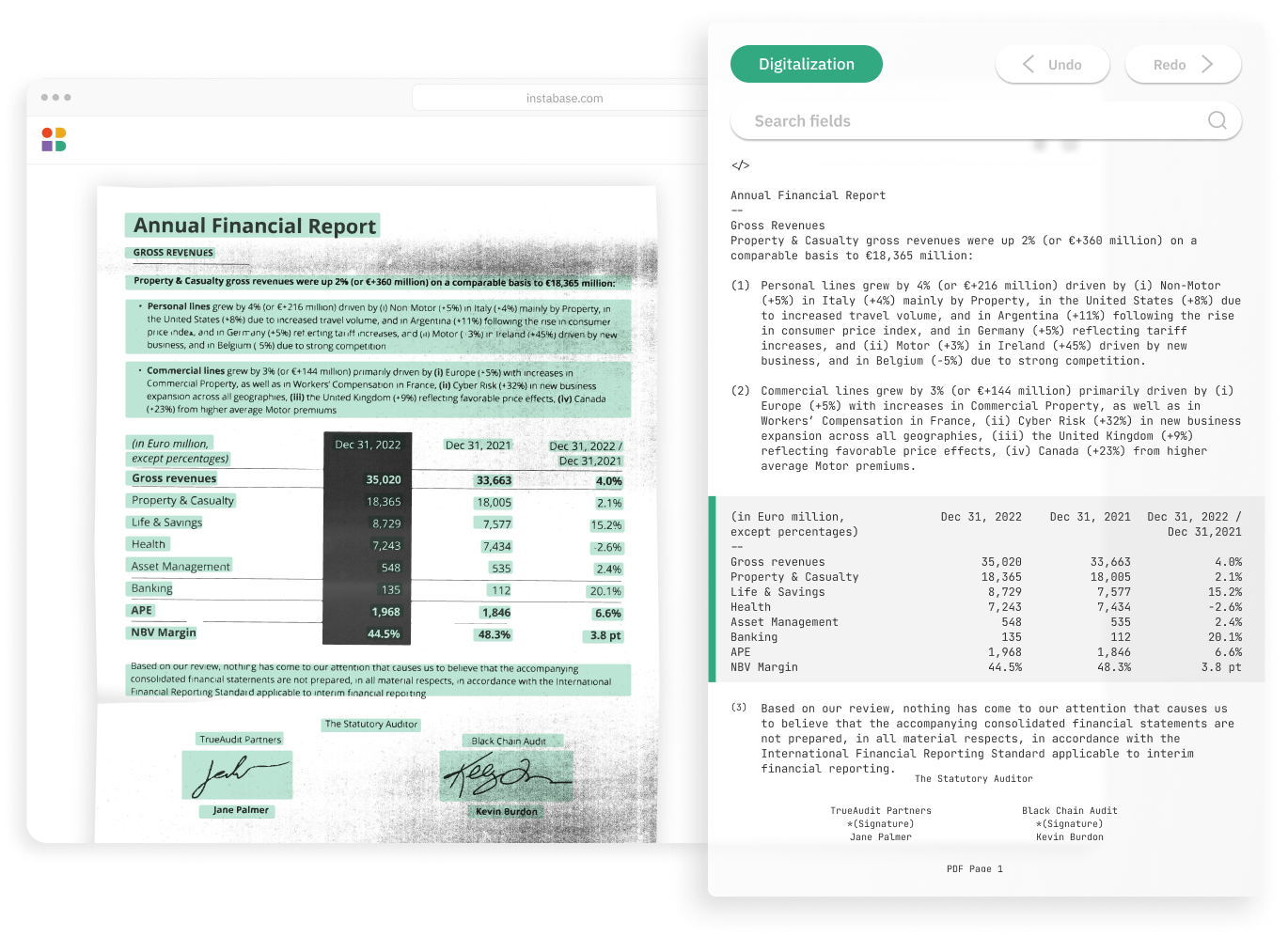

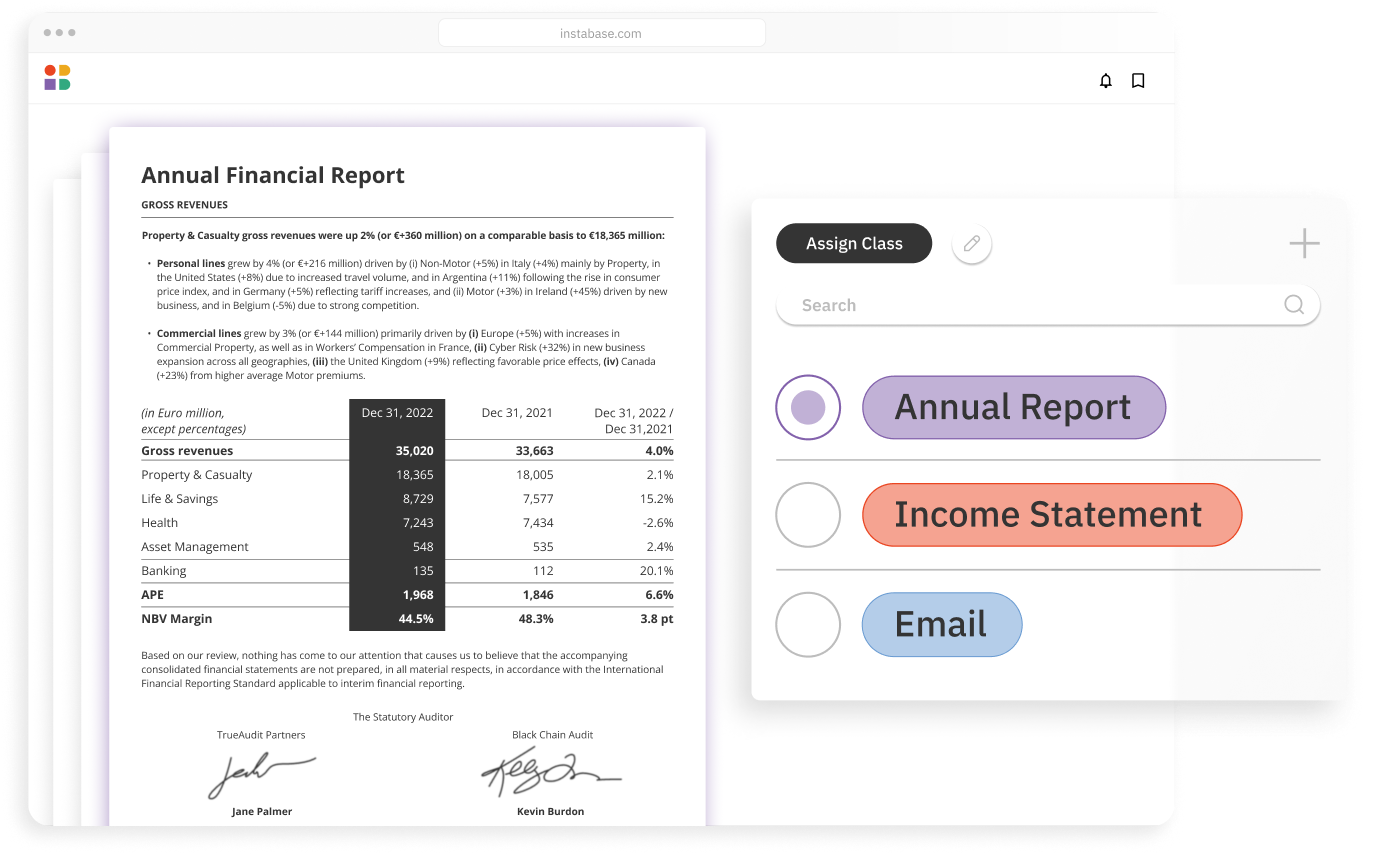

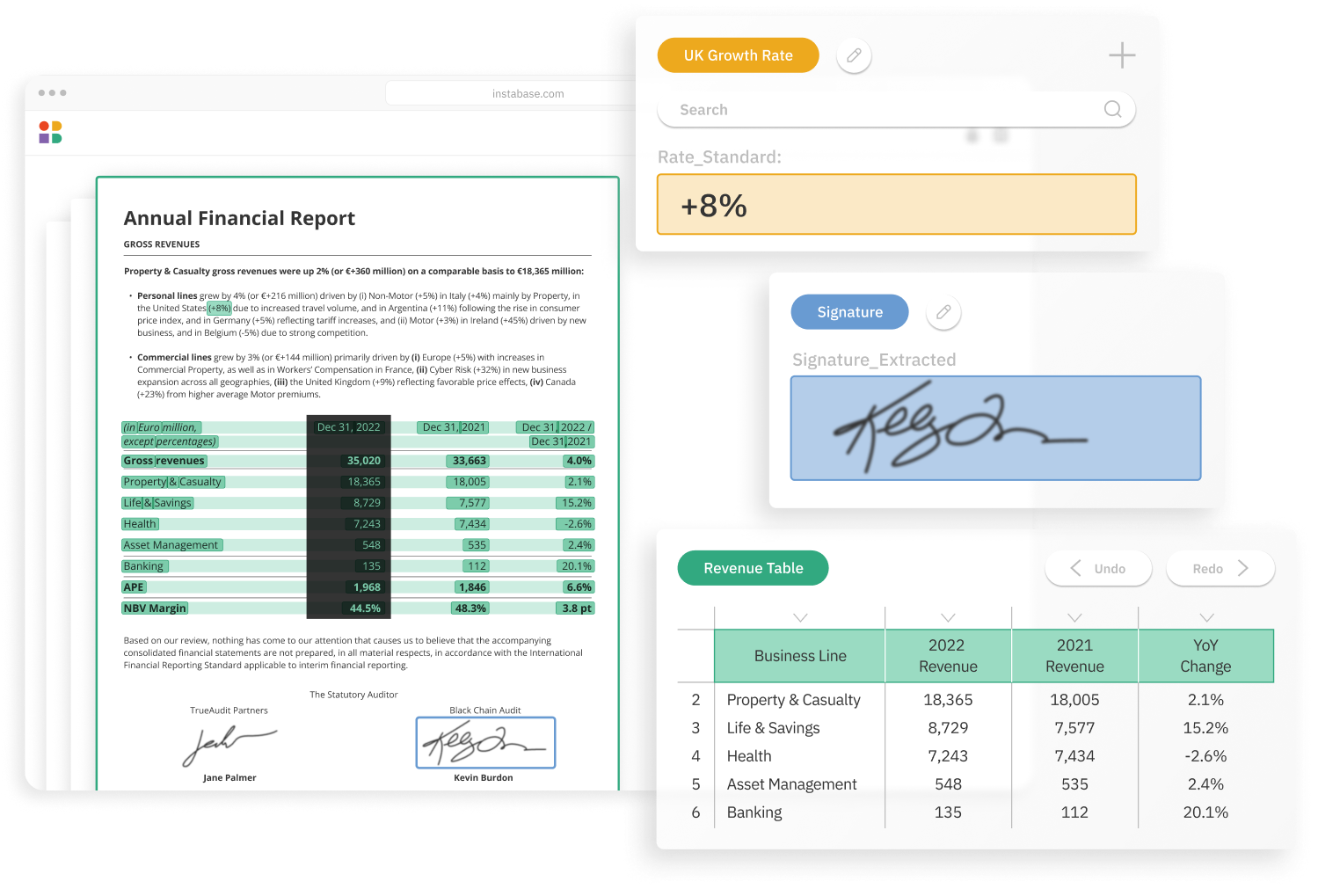

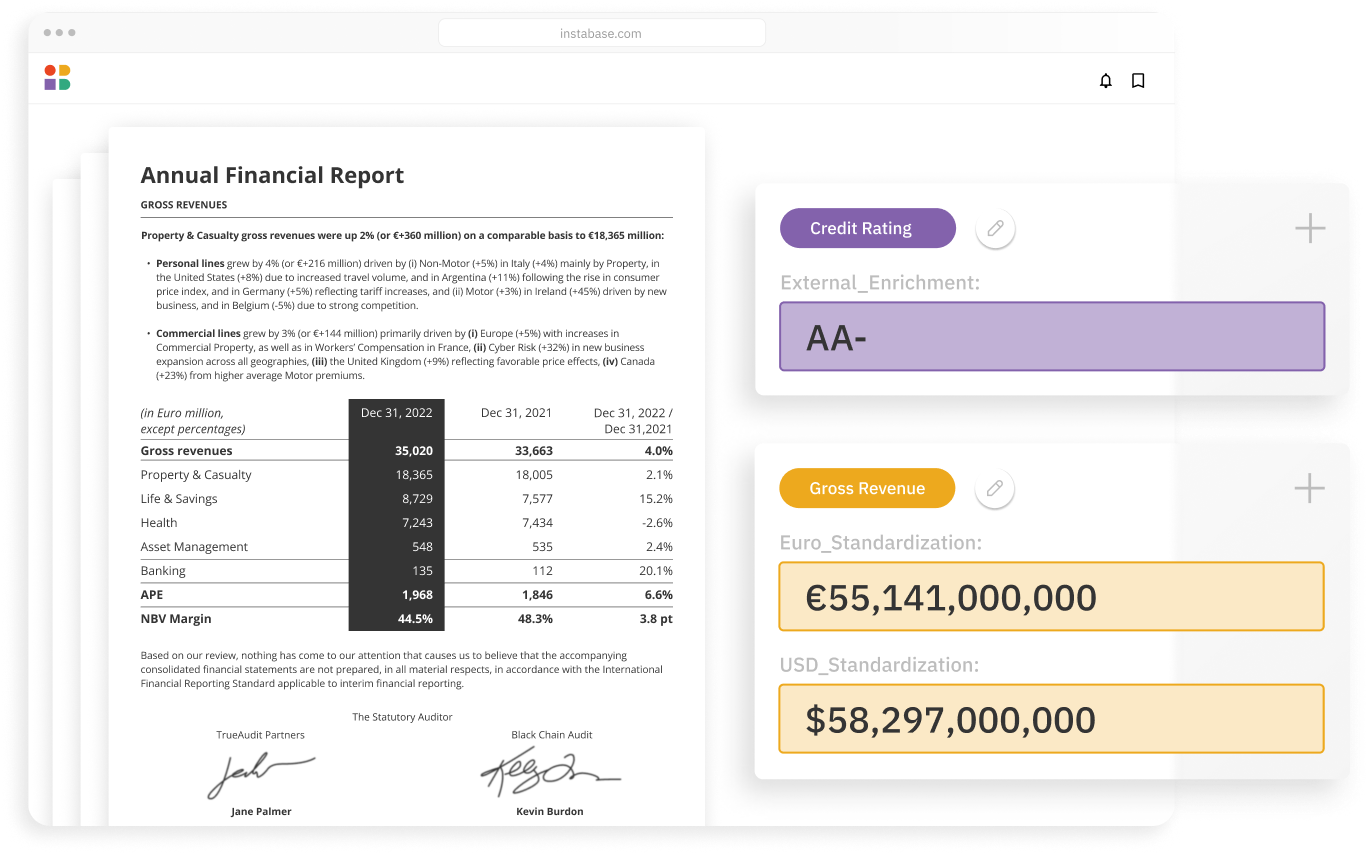

Instabase automatically splits up document packets, digitizes, extracts, and validates borrower data from documents, enabling underwriters to focus on risk assessment and decision-making to grow the mortgage book without growing costs.

Mortgage lenders using Instabase see improvements in processing times, risk management, and customer experience.

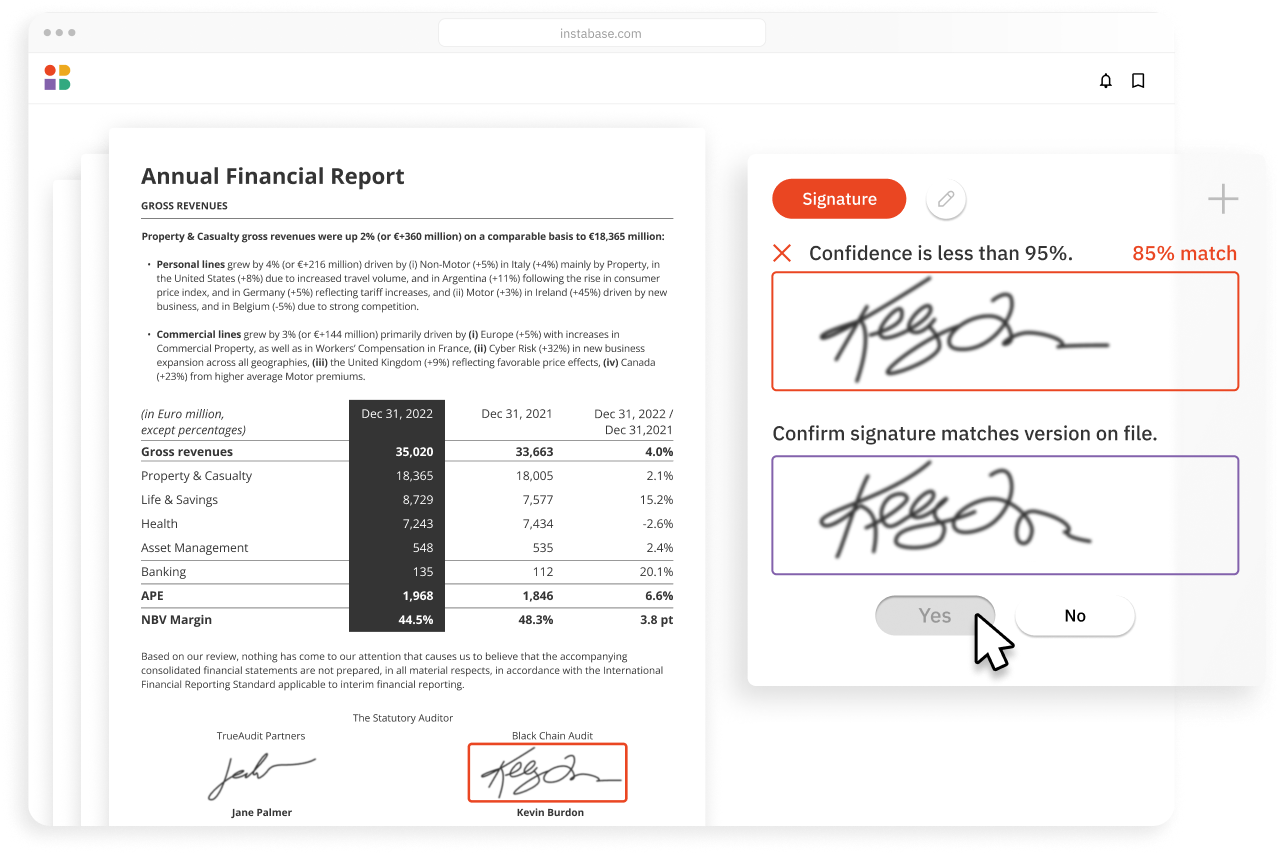

Unlock unstructured data that others can’t

Understand your most complex documents with the latest in AI from Instabase and the broader market

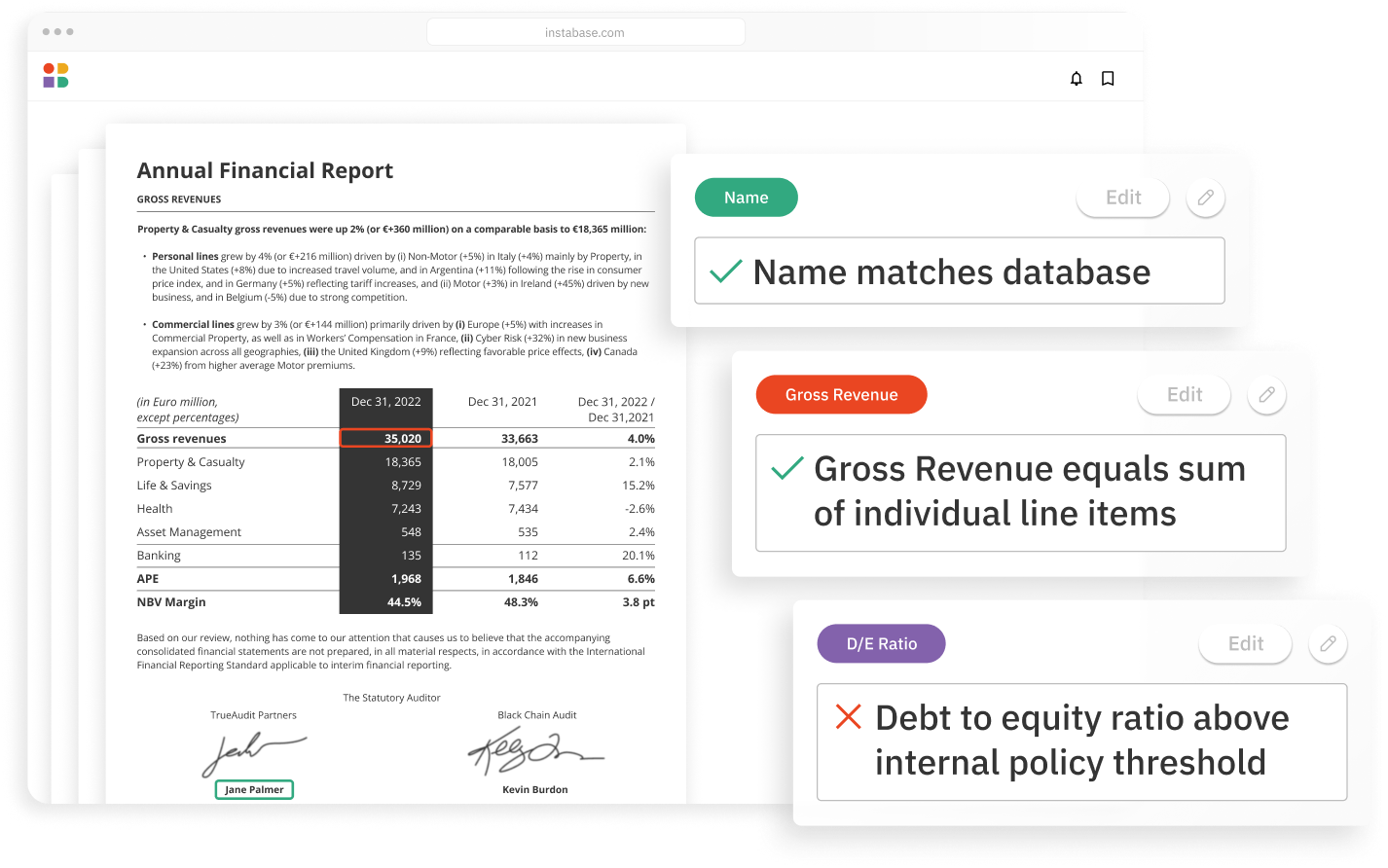

Achieve unrivaled automation & accuracy

Minimize errors and boost automation with an extensive suite of validations and business logic

Build solutions 10x faster

Launch end-to-end solutions in days with low code building blocks for every step in your workflow

How it works

Instabase combines the most powerful technologies for every step of the process, so you can automatically understand any document in the submissions process.